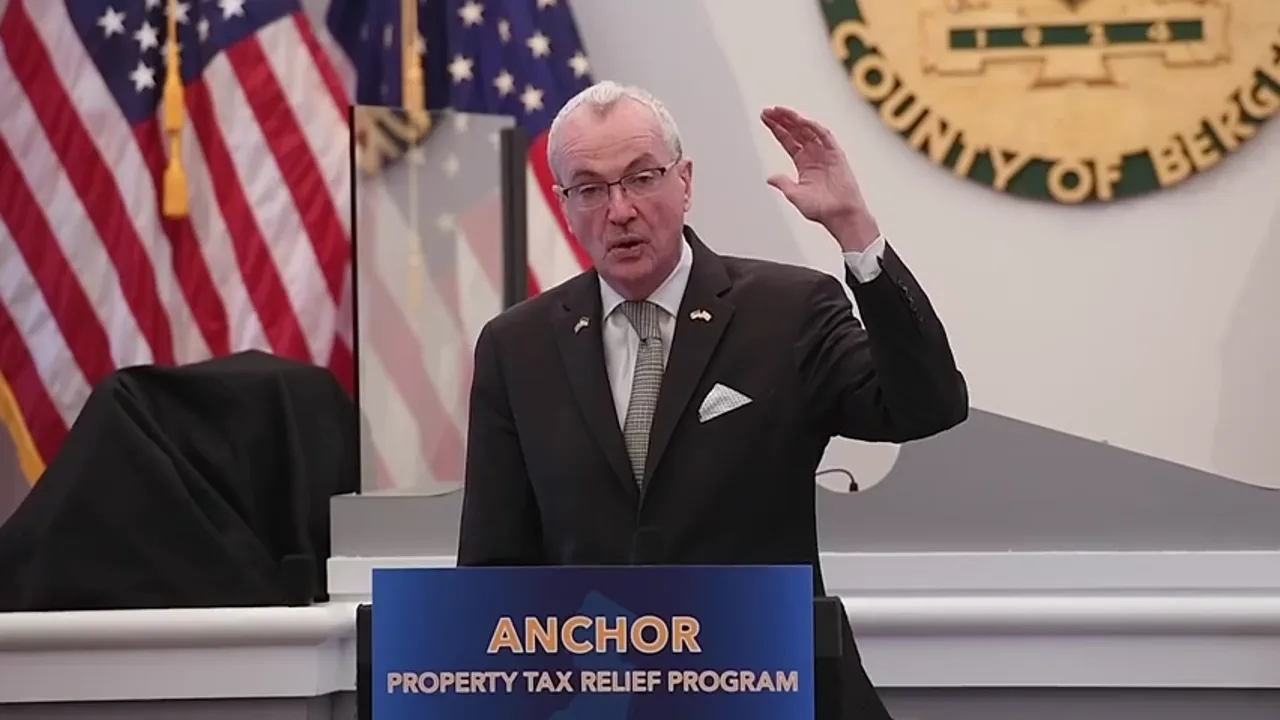

Residents of New Jersey Can Still Apply for Anchor Property Tax Benefits!

New Jersey residents still have time to apply for Anchor Property Tax Benefits. The program is designed to help homeowners who are struggling to pay their property taxes. The deadline to apply for the program is December 31, 2023.

The Anchor Property Tax Benefits program is available to homeowners who meet certain income requirements. The program provides a credit on property tax bills for eligible homeowners. The amount of the credit varies depending on the homeowner’s income and the amount of property taxes they owe.

To be eligible for the program, homeowners must meet the following requirements:

- The homeowner must be a New Jersey resident.

- The homeowner must own and occupy the property as their primary residence.

- The homeowner must meet certain income requirements.

The program is designed to help homeowners who are struggling to pay their property taxes. It is important to note that the program is not available to all homeowners. Only those who meet the income requirements are eligible for the program.

The Anchor Property Tax Benefits program is available to New Jersey residents who meet certain income requirements. The program provides a credit on property tax bills for eligible homeowners. The deadline to apply for the program is December 31, 2023. If you are a homeowner who is struggling to pay your property taxes, you may be eligible for the program. Please visit the official website for more information on how to apply.

Read More: Giuliani’s Defamation Trial Hears Details of Threats Made Against Georgia Election Workers!

Texan Supreme Court Rules Against Woman Who Wanted Abortion Permitted by the Court!

Two People Are Killed When A Fast Car Runs a Red Light in New Jersey!