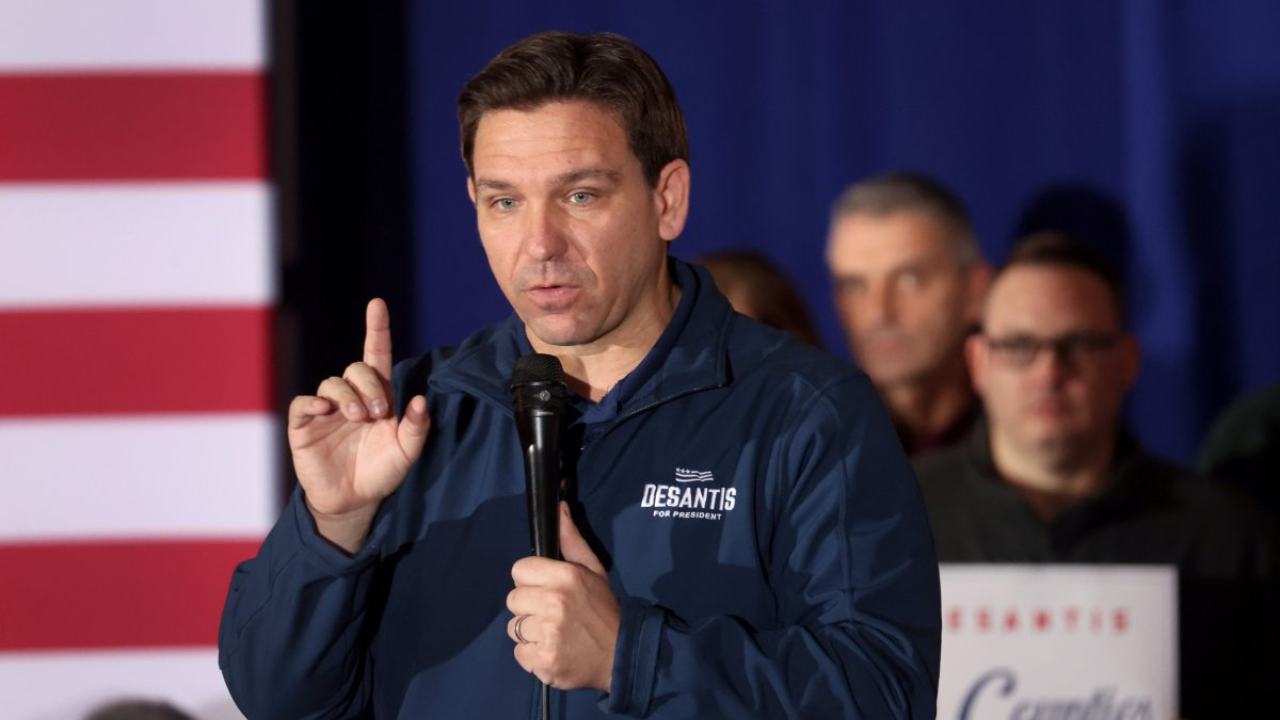

Insurance Companies in Florida Urge DeSantis Ally to Authorize Massive Rate Increase!

In response to mounting expenses and claims, two Florida insurance firms have taken the initiative to seek rate increases. This week, the state’s Office of Insurance Regulation (FLOIR), which is presided over by a commissioner appointed by Governor Ron DeSantis, heard arguments presented by Castle Key (a subsidiary of Allstate) and Amica Mutual Insurance.

As operational losses grow owing to payouts that exceed premiums collected, they pushed for increases exceeding 50%. During Tuesday’s meeting, Amica Mutual requested a 54.1% rate increase from Commissioner Michael Yaworsky. There are 17,000 homeowners with “fire dwelling policies,” including those with second homes or rental properties, but the company only said 500 of them would be affected by the rate adjustment.

Analyzing the Data

Under the new rule, policyholders will pay an average of $451—an increase from $295—according to Amica, which announced on Tuesday. “It’s a very small line of business for us,” stated Mike Petrarca, Amica’s Senior Assistant Vice President, during the public hearing. He went on to say that their Florida dwelling unit accounts for “about 500 policies” and “about one-tenth of one percent of our Florida premium and policy count.”

Amica claims a reported loss ratio of 337 percent is the result of operational losses exceeding premiums collected. That is to say, operational costs amount to about $3.37 for every dollar in premiums received. To guarantee that Florida homeowners will continue to have coverage, Petraca argued that these figures require significant rate adjustments.

“If approved, about 63% of our policyholders will see an increase of less than $200,” Petrarca stated, adding that the change is warranted based on the company’s policy metrics. After Tuesday’s public hearing, FLOIR did not make a decision and will take public feedback until March 5. On Wednesday afternoon, Newsweek emailed Amica Mutual to request a comment.

Castle Key formally petitioned Commissioner Yaworsky to accept their rate increase proposal for homeowners insurance policies in condominiums, which was submitted in March of last year, during Wednesday’s meeting. According to local news station WFTS Tampa Bay, around 105,000 customers have already been paying the higher rates since May 2023, even though the increase has a direct impact on them.

Until March 6, the FLOIR will accept public feedback following Wednesday’s public hearing at Castle Key and will not make a ruling. Castle Key and Amica Mutual Insurance are bringing attention to the worsening crisis in Florida’s insurance sector by pushing for unprecedented rate increases.

This mess is a sign of larger problems in the state’s insurance market, which have caused rates to be among the highest in the country and caused many insurance companies to leave the state. The average yearly cost of homeowner’s insurance in Florida has soared to $6,000, much surpassing the national average of $1,700, making it the most expensive state in the country for homeowners.

Read More News: Greg Abbott Talks with Oklahoma About Building a Wall Along the Texas Border!

Texas Abortion Opponents Protest a “Satanic” Figure at The University of Houston!

Sticky inflation, litigious environments that encourage excessive lawsuits, widespread fraud, and the increased risk of extreme weather events due to climate change are some of the many challenges that are fueling the premium surge. Because of these factors, insurance premiums have gone up, and big companies like Farmers Insurance and AAA have pulled out of the state’s market.

According to a previous report by Newsweek, many Floridians are now dependent on Citizens Property Insurance, the state’s insurer of last resort, due to the departure of private insurers. Citizens’ policy numbers have exploded due to this dependence, which makes one wonder if it will be able to meet future claims. Despite the state’s efforts to stabilize the market by welcoming six new insurers, homeowners are still in a precarious position due to the persistence of fundamental issues.

A bill to lower insurance premium taxes for properties valued at $750,000 or less has been proposed by Florida Senate leaders to alleviate the financial burden on homeowners. Critics, such as Democratic Representative Anna Eskamani, contend that the bill fails to address the fundamental issues, despite its intention to provide some relief from rising costs.