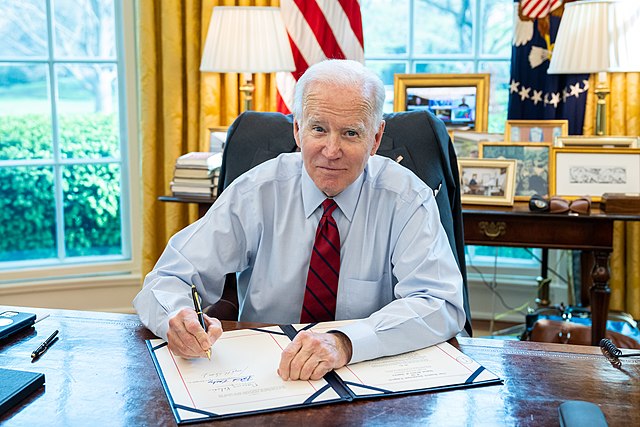

President Joe Biden’s alternate strategy for extensive student debt relief has progressed a significant step towards actualization.

Following extensive discussions on Thursday and Friday, a consortium comprising former students, advocates, and experts approved a proposal from the Education Department.

This proposal has the potential to grant forgiveness of student loans to a wide spectrum of financially distressed borrowers.

Biden’s Loan Forgiveness Sparks Political Controversy

During the same week, President Biden executed forgiveness of over $1 billion in loans for a distinct group of borrowers, a move that sparked criticism from conservatives in Washington who accused him of attempting to sway votes.

Undeterred, the president asserts his commitment to pursuing debt relief through various avenues.

The approved plan unveiled on Friday aims to provide automatic relief to borrowers facing financial hardship.

It grants significant discretion to the US education secretary in determining the eligibility criteria under the new regulation.

The secretary is empowered to consider various factors, such as income, age, and the probability of loan default, when making these determinations.

This regulation stems from the Supreme Court’s rejection last year of the Biden administration’s initial proposal for widespread student loan forgiveness.

Following that decision, the president pledged to explore an alternative route, navigating bureaucratic hurdles in pursuit of a similar objective.

Education Department’s Negotiation Deadline Draws Near

The Education Department is required to present a finalized version of their recent negotiations by November, following a 30-day period for public commentary.

The earliest potential implementation date for the rule is July 2025.

However, this timeline may face obstacles, including potential court challenges that could delay the process.

Since the Supreme Court ruling, federal authorities have been particularly cautious in framing their new proposals with precise legal language.

In the forthcoming months, borrowers will gain insight into the solidity of the new plan.