California’s Stimulus Boost: What You Need to Know for February 2024 Overview!

CNS News–In response to evolving economic conditions, states across the nation are implementing measures to support their citizens. California, in particular, approved the California Stimulus Check in February 2024, aiming to provide financial assistance to eligible individuals. Here’s what you need to know about this program, including eligibility criteria, payment details, and more.

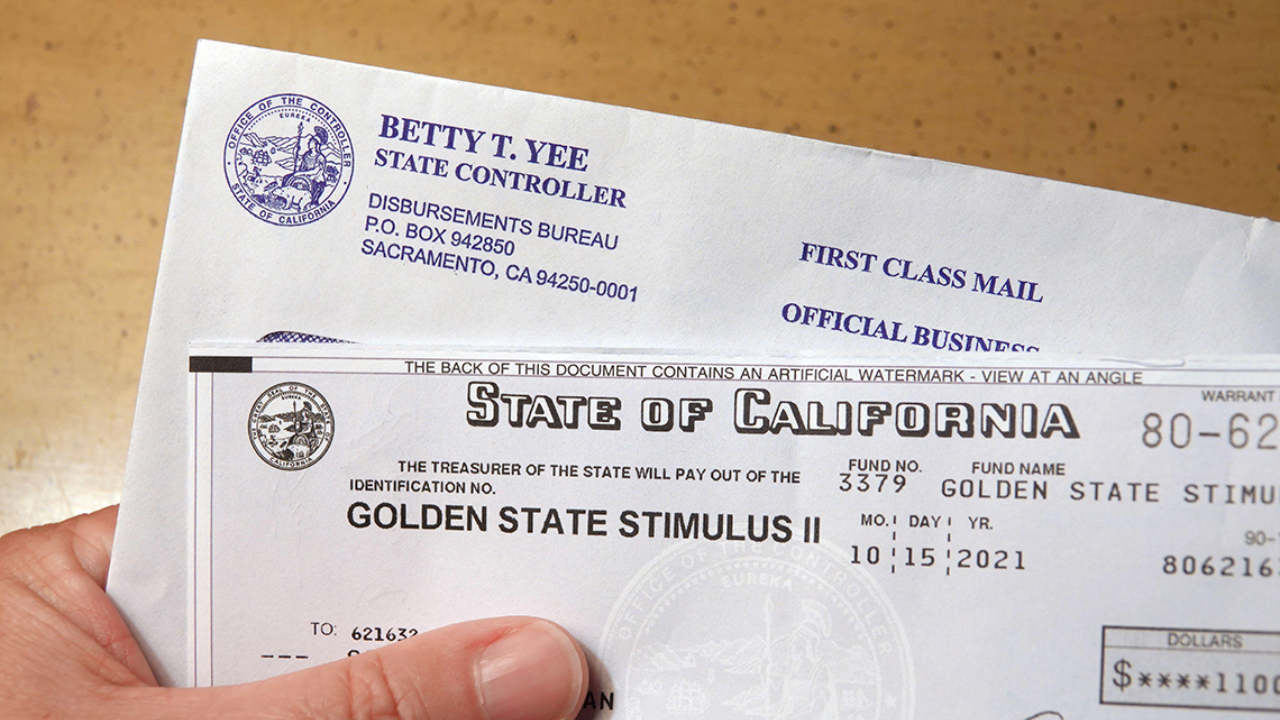

California Stimulus Check Overview

The California Stimulus Check, also referred to as the Golden State Stimulus Check 2024, is a state-specific program designed to offer financial aid to eligible Californians. Unlike federal stimulus packages, this initiative is tailored to address the unique economic challenges faced by residents of California.

Eligibility Criteria

To qualify for the California Stimulus Check, individuals must meet specific requirements established by the state:

- US Citizenship: Only citizens of the United States are eligible for the California Stimulus Check in February 2024.

- No Application Required: Eligibility is determined based on various factors such as filing status and income levels, eliminating the need for individual applications.

- Income Threshold: Applicants must have an income below or within predetermined thresholds. For married couples filing jointly, the total income must not exceed $500,000, while single filers must earn less than $250,000.

- Dependent Status: Individuals listed as dependents on another person’s tax return may also qualify for the stimulus payment, with slightly adjusted income thresholds.

The amount of the stimulus check varies based on filing status and income, ranging from a minimum of $500 to a maximum of $1200.

Payment Distribution

The distribution of the California Stimulus Check is designed to ensure timely delivery to eligible recipients:

- Timeline: Payments are disbursed based on the date of the individual’s tax return filing. Those who filed between January 1, 2023, and March 20, 2023, began receiving payments from April 15, 2023. Payments for filers between March 2, 2023, and April 23, 2023, were issued by May 1, 2023.

- Payment Method: Recipients may receive payments via paper check or direct deposit. While paper checks may take up to six weeks to arrive, direct deposit payments typically arrive within two weeks.

- Late Filers: Individuals who filed their tax forms after April 23, 2023, may experience slight delays in payment processing. These late filers can expect to receive payments via paper check within 60 days or via direct deposit within 45 days.

Payment Amounts for Different Income Levels

The amount of the California Stimulus Check is determined by the beneficiary’s filing status and income level. For married couples filing jointly, the payment amounts are distributed as follows:

- Income Limit: $150,000 or less

- Payment with Dependent: $700

- Payment without Dependent: $350

- Income Range: $150,000 to $250,000

- Payment with Dependent: $500

- Payment without Dependent: $250

- Income Range: $250,000 to $500,000

- Payment with Dependent: $400

- Payment without Dependent: $200

- Income Limit: $500,000 or more

Read More News: Congress Mulls Over Social Security Overhaul Amidst Supreme Court Scrutiny!

Updating Social Security: The First $4,873 Payment for February Is Due in Three Days!

In 19 Days, $943 March Social Security Payment Set to Boost Household Budgets!

Overall, the California Stimulus Check February 2024 aims to provide much-needed financial assistance to eligible individuals, addressing various financial challenges they may face. By implementing an organized payment distribution system and flexible eligibility criteria, the program seeks to support Californians across different financial circumstances and filing statuses, contributing to the state’s economic resilience and recovery efforts.