Company Building Satellite Constellation Despite Russian Anti-satellite Threats to Rival SpaceX

The presence of Russian nuclear weapons in space may seem like a plot from a science fiction book, but US intelligence suggests that the danger is becoming more tangible.

In particular, Russia has been working on the ability to eliminate satellites in space using its space-based nuclear weapons, which could cause significant damage to essential information systems.

John Kirby, the spokesperson for the White House’s National Security Council, confirmed the concerning information, stating that it is connected to Russia’s development of anti-satellite capabilities.

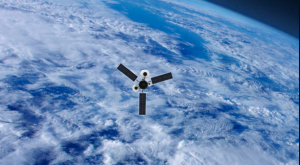

Interestingly, at the same time the concerns of American officials about the new Russian nuclear weapon were being revealed, Rocket Lab USA (NASDAQ:RKLB) is advancing its efforts to compete directly with SpaceX in the satellite constellation industry and is gaining the backing of the US government.

Rocket Lab concluded 2023 by revealing a $515 million US government contract it secured to manufacture 18 satellites for the Space Development Agency. With Rocket Lab’s current market cap at approximately $2.5 billion, this contract accounts for nearly 20% of the total market cap.

“Looking ahead to our ultimate goal, we aim to follow the successful path of [SpaceX] by gradually moving into the applications market.” We are currently assessing various opportunities for constellation applications,” stated Rocket Lab’s CFO, Adam Spice.

Aside from this significant contract, Rocket Lab is actively seeking additional merger and acquisition opportunities to strengthen its position in the industry.

In the current market environment, the company recently completed a $355 million convertible note offering, citing the challenging landscape for raising capital.

Rocket Lab made its public debut in August 2021 through a special purpose acquisition company (SPAC) during a surge in SPAC activity.

Despite a significant drop in shares sold just before the closing of the SPAC merger, CEO Peter Beck remains unfazed by short-term fluctuations in the stock price, emphasizing a long-term perspective in an interview with CNBC.

Investors Monitor For-Profit Space Industry Amid Geopolitical Tensions and SpaceX Dominance

Given the recent rise in geopolitical tensions between Russia and the United States, along with concerns about a potential space conflict following Russia’s latest actions, investors may want to keep a close eye on the for-profit space industry.

SpaceX is currently leading the way, but it may be beneficial for national security for the government to diversify its investments to promote competition in the United States’ space industry.

Since SpaceX remains a private company, investors can choose to invest in one of its main competitors without having to wait for SpaceX to become a public company.