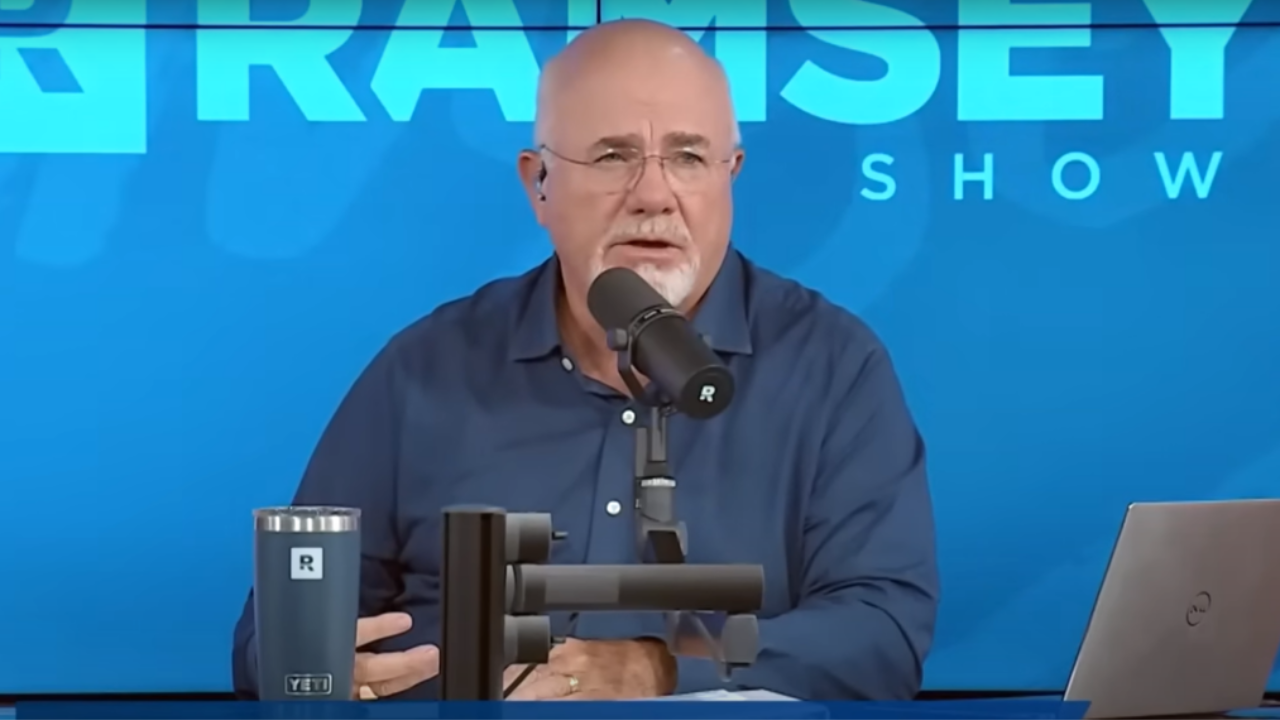

Three “Dumb” Social Security Myths That Dave Ramsey Suggests You Ignore!

CNS News– Personal finance guru Dave Ramsey has dedicated his career to enlightening individuals on the essentials of financial planning, particularly in securing a comfortable retirement. Ramsey recently took to his platform to address prevalent misconceptions surrounding Social Security and federal benefits, aiming to steer individuals towards a more informed financial future.

Myth No. 1: Social Security Alone Will Provide a Comfortable Retirement

Ramsey begins by dispelling the myth that Social Security alone can ensure a comfortable retirement. Contrary to popular belief, relying solely on government provisions is ill-advised, as highlighted by Ramsey’s assertion that “Relying on the government to take care of you in retirement is dumb with a capital D.”

He elucidates this point by referencing data from the Social Security Administration, which reveals that retirees received an average monthly benefit of $1,657 in 2022, amounting to a mere $19,900 annually. Expounding on the inadequacy of Social Security benefits, Ramsey underscores the substantial disparity between these benefits and the actual cost of living.

Citing a report, he notes that retirees in West Virginia require at least $49,261 annually, while those in Hawaii necessitate a staggering $103,610. This glaring incongruity underscores the imperative of supplementing Social Security with personal savings and investments.

Myth No. 2: Medicare Will Cover All Your Healthcare Costs

Ramsey proceeds to address the misconception surrounding Medicare coverage, emphasizing that while Medicare subsidizes healthcare costs for individuals aged 65 and above, it does not cover all expenses comprehensively.

Costs such as deductibles, co-pays, and long-term care exceeding 100 days remain the responsibility of the individual. GOBankingRates reported that assisted living facilities average $4,500 per month. However, a shared nursing home room costs $7,908 and a private room costs over $9,000.

Studies show that 70% of 65-year-olds will need long-term care, which Medicare won’t cover. Ramsey advised long-term care insurance. Health Savings Accounts (HSAs) allow tax-free growth and tax-free withdrawals for retirement healthcare.

Myth No. 3: Social Security and Medicare Will Be Around When You Retire

Read More News: Social Security to Make Major Payroll Change to Reduce Overpayments!

Seniors in Arizona Expect Trump and the GOP to Cut Social Security and Medicare!

15 Facts You Should Be Aware of Regarding Social Security Disability Insurance!

Ramsey concluded that these government safety net programs may not exist when you retire. Ramsey wrote that unless Congress finds a way to close the Old-Age and Survivors Insurance (OASI) Trust Fund shortfall, Social Security benefits could be cut by more than 20% in 2033, depending on age.

To preserve Medicare for future retirees, the federal government may have to raise the eligibility age, raise premiums, or cut coverage. Ramsey reiterates that “Your retirement is your job — not the government’s,” underscoring the necessity of proactive financial planning to secure a stable retirement.